|

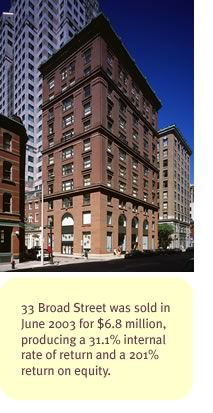

33 Broad Street,

Boston, MA

Soon after forming Fairlane Properties

in 1997, Michael Grill contacted MGI Properties, a NYSE

REIT and former client, about 33 Broad Street. MGI had purchased

the 37,662 square foot property in 1994 and was facing capital improvements

and leasing challenges, including the potential loss of 60% of leases

expiring in 1999. Operating expenses had ballooned during renovation

projects, and potential buyers were unlikely to reduce these expenses

in the underwriting of the property.

In

the coming months, the property was not offered to sale to the marketplace.

Building information was provided, however, to Fairlane, who closed

on the sale for $3.15 million in October 1997 with debt financing

of $2.525 million and equity capital of $1.275 million from eight

investors. In

the coming months, the property was not offered to sale to the marketplace.

Building information was provided, however, to Fairlane, who closed

on the sale for $3.15 million in October 1997 with debt financing

of $2.525 million and equity capital of $1.275 million from eight

investors.

Fairlane completed capital improvements to the lobby, roof, cooling

tower, façade and construction of a handicapped-accessible

restroom. Interior common areas were redesigned, transforming the

property into a sophisticated professional environment with renovated

lobby and refurbished elevators. Fairlane also reduced operating

expenses by 18% between ‘97 and ‘98. Six of the eight

tenants with expiring leases renewed. Capital improvements, tenant

improvements and leasing commissions of $480,000 were budgeted with

a total project budget of $3.8 million.

The 1997 business plan for 33 Broad Street called for a refinancing

of the property in 2001 with a 50% return of equity. In January

2000, 47% of investor contributions were returned as part of a short-term

financing. The remaining equity was returned with the placement

of long-term financing in March 2001 with an additional 45% in excess

proceeds returned to investors at that time. From 1998 to 2003,

the building’s floors were remeasured, increasing the total

rentable square footage to 40,680. |